Retired people may find that their financial strength lies in their homes, not in their bank accounts. A reverse mortgage is a great way to borrow funds against your property’s equity. This method can help you add to your monthly income, spend on better quality living, or even invest further. However, there are certain qualifying...

4 Tips About Personal Finance From Industry Experts

From student loans to credit card debt, a lot of people these days are struggling to pay back the money they once borrowed from a bank, financial institution, or a friend. Not paying back the money can not only add to the interest but also destroy relationships. “55 percent of Americans with credit cards have...

Common Questions About IF-ISAs

Innovative Finance ISAs are investments that give consumers the opportunity to earn tax-free returns through a Peer to Peer lending platform. IF-ISAs are among the newer types of ISA, having first been introduced to the public in 2016. We asked the Investor Relations team at Kuflink to answer some of the most frequently asked questions...

Are Hidden Fees Costing You Your Financial Goals?

Have you ever gotten a bill and found that you were charged more than you expected? Most Americans have had this experience. Vague charges labeled as “service fees” or “other” leave you not only responsible for sending over more of your hard-earned money but completely unsure of what your money is actually going towards. Often,...

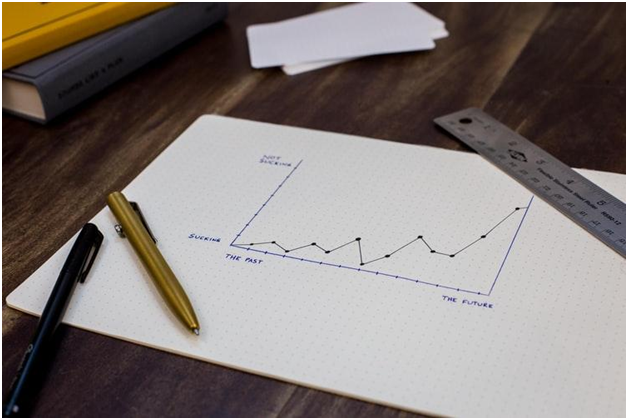

7 Small Changes That’ll Make a Big Difference in Your Finances

Major steps like investing in a 401k or buying high-risk/high-reward stocks often make big changed in your finances. But oftentimes, it’s the little things that people forget that can make this biggest difference. To better your finances, sometimes, you also have to lower your standard of living and adopt an alternative lifestyle–at least temporarily. This...

What is a Trustee?

A trustee is an institution or person (like a bank or trust company) placed in charge of managing the property and other assets placed in a trust for the benefit of someone else (known as the beneficiary). Trustees have the fiduciary duty to put aside their personal goals in order to do what is best for...

How Mindfulness Can Help You With Your Personal Finances

When most people hear the word “mindfulness”, they think of a person meditating in the lotus position while burning incense. However, the truth is that mindfulness doesn’t require chanting, patchouli, or yoga. Mindfulness is something you can easily incorporate into your everyday life. It can help improve your personal financial situation, especially if you’ve been...

What Gen Z Can Teach Us About Finances

We have often been told that “wisdom comes with age.” But if you’re an adult who has perhaps raised some of the youngest members of the workforce, there’s some good news. Members of Gen-Z, born between 1997 and 2012, seem to have a distinct perspective and attitude towards their finances. So, let’s learn some of...

Are Mutual Fund Reported numbers net of Fees?

Are mutual funds reported numbers net of fees? Well this answer really depends on your “operating expenses”. In order to clear this ambiguity, let us assume a cinematic metaphor. The cost related to a mutual fund is similar to the cost associated with visiting a movie theatre. For instance, assuming the price of a ticket...

Market Milestones as the Bull Market turns 10

March 9, 2019, was a mark of the 10-year anniversary of the longest considered bull market in our history. March 9, 2009, was the post-crisis low to start it. In early 2009, the S&P 500 had a closing price of 676.53 on that fateful day. The S&P 500 settles for 2743.07 as the market closed...