We’re always looking for ways to bring in more cash. Whether you need to pay off a few more bills or to increase your retirement fund, the more money you can bring in, typically the better off you will be. Besides your monthly income, do you have other ways you bring in cash? Many individuals,...

Home

earn money

Tag: earn money

Post

Do you want to make some extra money this winter?

https://cdn.pixabay.com/photo/2015/11/23/16/51/box-1058651_960_720.jpg As the days get shorter, many people are looking for a way to make some extra money. Winter means the holiday season for most, so why not make up for the huge amount of expenses that likely spend through Christmas and the New Year? Here are some unique ways in which you can make...

Passively Earn Money by Helping Consumers in Need

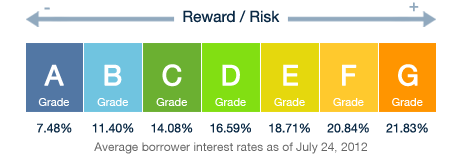

Debt can be profitable even for us, the consumers. Banks make billions of dollars by loaning money and charging interest payments to borrowers. Granted, you may not become a billionaire, here’s how you can create a nice stream of income by funding consumer loans. Let’s say you have $5,000 you could loan out. You can’t...