Debt can be profitable even for us, the consumers. Banks make billions of dollars by loaning money and charging interest payments to borrowers. Granted, you may not become a billionaire, here’s how you can create a nice stream of income by funding consumer loans.

Debt can be profitable even for us, the consumers. Banks make billions of dollars by loaning money and charging interest payments to borrowers. Granted, you may not become a billionaire, here’s how you can create a nice stream of income by funding consumer loans.

Let’s say you have $5,000 you could loan out. You can’t just post a Craigslist ad saying you’re available for loans. Not only would it take too much time to respond to all the emails you’re going to get, but you’d also have to go through the trouble of qualifying all the respondents and figuring out whether they’re trustworthy borrowers. That hardly qualifies as passive.

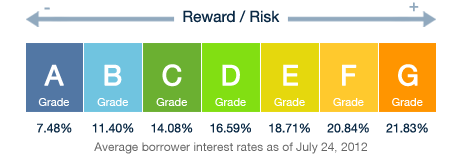

There’s an easier way. Using a peer-to-peer lending network like LendingClub.com or Proper.com solves that dilemma. P2P networks act as a middleman, bringing together people who need loans with investors who have the money to fund these loans. The networks vet the borrowers and assign a credit risk grade. At Prosper.com, borrowers are categorized into buckets from AA, lowest risk, to HR, high risk, or unknown risk. Lending Club’s system is similar, ranging from A to G.

Investors can choose to take on risky or less risky borrowers, or a mixture of the two. The risky borrowers pay a higher interest rate so you earn more money on these loans. However, there’s a greater likelihood that the riskiest borrowers will default on the loan and you’ll lose your investment. The safer borrowers come with a better guarantee of repayment, but the interest on these loans isn’t as high.

Once you’re signed up, you can review borrowers individually and choose to fund loans or you can select investment criteria and let the network invest for you. Obviously, letting the network choose loans for you is the most hands-off method. However, you may prefer to hand-select your borrowers to have more control over who you lend to. You can even decide to automatically reinvest your interest earnings or you can withdraw the funds as you receive loan payments.

The good thing about P2P networks is that several different investors can fund one loan. So, you don’t have to put 100% of your investment into a single loan. Instead, you can spread your funds over many different loans, lowering the risk that you’ll lose everything if a borrower defaults. For example, if you’ve invested $50 in 100 different loans and one borrower defaults, you’re only out of $50 instead of the entire $5,000 you invested.

Return on investment is pretty good from both the major P2P networks. Prosper boasts investor returns between 5.18% and 17.71% while Lending Club’s average returns range from 5.38% to 13.47%. Each monthly payment consists of principal and interest. The network will keep a small percentage of the payment for their services. You keep the rest.

Repayment terms are from 1 to 5 years, so you won’t get all your money back immediately. You’ll just have to be patient while the payments roll in. Start small and decide how much you’d like to invest based on your initial investment and your available capital.

Leave a Reply