In today’s economy, many people are living from one paycheck to the next. It seems like they cannot get ahead as financial opportunities are hard to come by. No matter how much they try, they are tapped out financially, bills keep coming in along with unexpected expenses. If you are one of these people, you know the struggles all too well of trying to find your way out of the financial hole that burdens so many people today. Several things could be causing you to struggle just to make it from one paycheck to the next. Check out some of the common culprits below.

What used to be a luxury is now a need.

If you were to take a look around your home, you could probably find several different things that you don’t need. These luxuries can drain your bank account quicker than you realize. Things like cable or satellite television, eating out at your favorite restaurant, and buying a fancy pair of pumps are all things that you can do without. Unfortunately, many people are so into the habit of having these nice things that they cannot seem to break free from the circle and put an end to their problems once and for all. You need to realize what things are necessities and what things are luxuries. That will help you reorganize your finances fairly quickly.

You aren’t making enough money – poor cash flow.

One of the main reasons why people are forced to live from one paycheck to the next is because they aren’t making enough money to make ends meet. Whether it be that you are underemployed or you simply aren’t looking for better-paying work, you need to take a step back and reevaluate your financial situation from a realistic perspective. Stop and really think about what you need to make each month to be comfortable with where you are in life.

Taking advantage of benefits is another way to increase your monthly cash flow. Getting subsidies on certain bills can make a huge difference to the budget. Avoid taking out high-interest loans for emergencies and look for alternative assistance like advance benefit payments or other government or non-profit sponsored loans.

You are stuck in your ways.

Many people get to the point in life where they just assume that they are stuck in their current situation and there is nothing they can do to change it. However, that isn’t anywhere near the case. You don’t have to deal with the struggles you are. You have the power to put an end to credit card payments and car payments. You can choose what you want and what you want to kick to the curb.

You have to do something new to change your situation, have more education, or ask for more responsibility in your current role.

You are spending too much.

Countless individuals spend more money than they bring in each month. You need to be the one to put a stop to your spending and gain control of yourself. You need to look at what you are spending and how you are spending it. Planning and coming up with some plan of action can go a long way in controlling your bad habits. You should never spend above your means.

By identifying the main reason why you are living from one paycheck to the next, you can begin doing something about it and changing your financial situation around for the better.

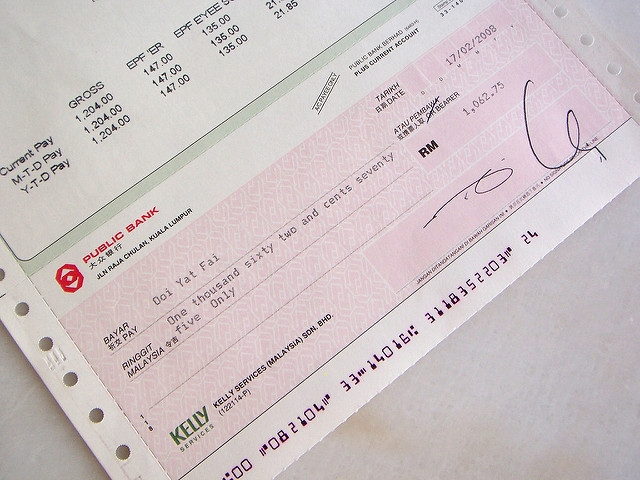

Image via Flickr

Leave a Reply