The risk lies at the very core of trading. Without risk, the profit would not be possible. On the flip side of the coin, because of that risk, there is the danger of big losses befalling you. However, as necessary as taking risks is if you’re to turn a profit, by using stop losses intelligently, you can protect yourself from the nasty surprises that compromise an unavoidable part of trading.

The risk lies at the very core of trading. Without risk, the profit would not be possible. On the flip side of the coin, because of that risk, there is the danger of big losses befalling you. However, as necessary as taking risks is if you’re to turn a profit, by using stop losses intelligently, you can protect yourself from the nasty surprises that compromise an unavoidable part of trading.

Indeed, employing stop-loss orders properly is a function of having the right mental attitude to be a successful trader; knowing that you cannot and will not win every time. Putting on a seatbelt when you step into a car isn’t something you do because you are expecting to crash, or because you doubt your own abilities as a driver. You do it (aside from the fact that it’s illegal not to) because you are acknowledging that out there on the roads some forces are simply beyond your control.

Give Yourself a Safety Net

By using stop-loss orders cautiously and tightening them when things look uncertain you can make sure your losses are minimized. Furthermore, by using a stop-loss order, ahead of time you reduce the chances that you will succumb to the trader’s great enemy; hope. Whilst hope could cause you to keep a losing position open longer than necessary, a stop-loss order can act as a signpost definitively telling you when to get out.

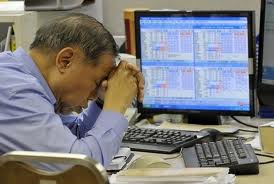

This has a double benefit, in that big losses hurt you not just financially but psychologically, which can lead to more problems further down the line. Making money trading is about consistency, not making one-off miracle trades. However, if you have big losses to make up you are much more likely to be drawn into bigger gambles or “revenge trades” where you try and get your own back on your misfortune.

The core of a good trade plan is to pick your exit point at the same time as you decide on an entry point that you’re happy with. Stop-loss orders help you stick to such a plan. This may sound limiting given how fast markets can move, but using a trailing stop-loss order, you can automatically have your exit point move up behind the price as it rises (assuming that it does!).

Exceptions Prove the Rule

Of course, there are some trades where you may have a decent reason to leave a stop loss out of your strategy. If for example, you’d picked up an extremely volatile stock due to a conviction that it would, overall, go up in price over a period of years, you’re going to be ignoring month by month fluctuations in price, even if they do take a considerable tumble. In this scenario, given the risk you’ve taken on, a stop loss is unlikely to be of much use to you.

However, unless this is your mindset from the very outset before you even buy the stock, you shouldn’t adopt such a tactic. Don’t babysit a bad trade out of pride or frustration at the way prices are going in vain hope that the situation will soon be reversed.

One of the most important mental attributes a good trader needs is the ability to take a (preferably minimal) loss, learn from it, and move on. Stop losses can help you do just this, by alerting you early on to a trade that just isn’t working out.

Leave a Reply