This infographic is originally published on Have I Got PPI UK, a CMC based in Manchester, UK.

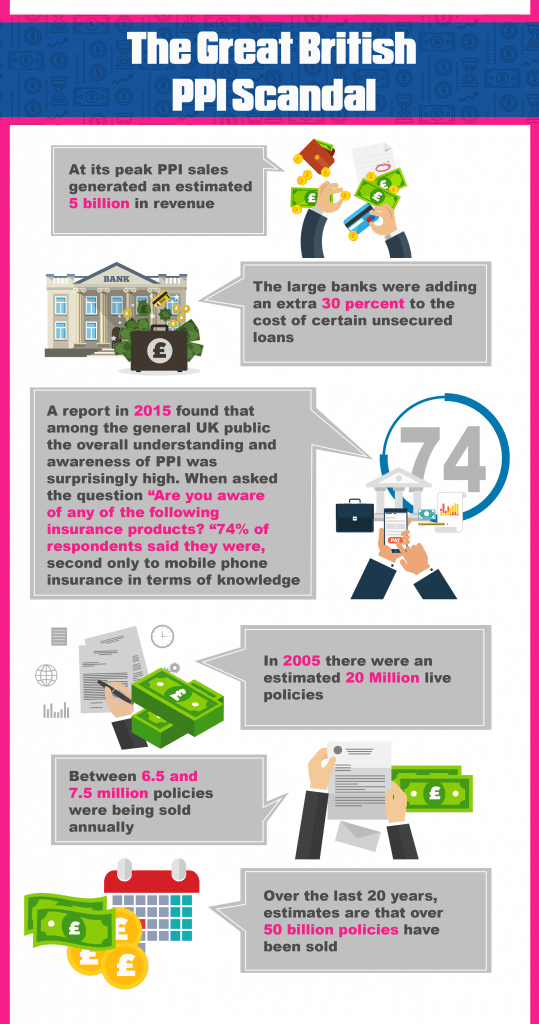

The United Kingdom’s banking industry is struggling to recover from the aftermath of the payment protection insurance scandal. This disaster has already cost the largest banks more than £10.5 billion over the past two years. The PPI crisis continues to grow each month, but banks may have another problem that they need to deal with. The Financial Conduct Authority has recently announced that a credit card fraud insurance scandal is also starting to plague the industry.

Background of Credit Card Fraud Insurance

The Financial Conduct Authority began an investigation into a firm known as CPP last year. CPP provided credit card fraud insurance to High Street banks between 2006 and 2011. The FCA found that CPP and the banks colluded to trick unwitting customers into purchasing the insurance.

Many customers were misled into believing the insurance would offer more coverage than they already received. The banks told customers that they could use the insurance to protect themselves if someone stole their credit cards and rang up fraudulent purchases. However, the banks already offer this protection so there was no real incentive for customers to buy it.

Structure of the Insurance

Credit card fraud insurance premiums were typically about £120 a year. In exchange, the banks promised customers coverage for up to £100,000 in fraudulent credit card purchases. Customers with the insurance were also deceived into believing they would be insured for up £60,000 in identity theft.

The protection against fraudulent credit card purchases was moot. The Consumer Credit Act of 1974 already requires financial institutions to reimburse cardholders for fraudulent purchases. The protection against identity theft may have been beneficial if it actually worked as promised. However, the £60,000 would actually be used to cover administrative costs rather than reimbursing the consumer for their losses.

Financial Scandals Continue to Grow

The PPI and credit card fraud insurance crises are beginning to take their toll on the banks. The new scandal probably won’t have the same impact as the PPI mis-selling debacle. However, the FCA still expects that it will cost the banks approximately £1 billion.

Customers already began to lose faith in the banking system after PPI mis-selling was first exposed. Many customers have worked with a PPI refunds company after they learned they may have been mis-sold the financial product. They will probably file more claims in the future as the problem gains more attention. The new credit card insurance debacle will probably cause them to lose even more faith in the banking industry. Many customers have stated that they will be reluctant to trust the banks again until they have proven that they are changing their practices.

Leave a Reply